Discount is reductions to a basic price of goods or services. vAccount allows you to set Discount Rules. You can add your Discount Calculation Rules for Income/Expense Transactions. To manage Discount, please go to vAccount => Discount (or go to Dashboard and click on Discount icon). On the page, you will see list of Discount which you created and you will be able to add/edit/delete/publish/unpublished Discount using the buttons on toolbar.

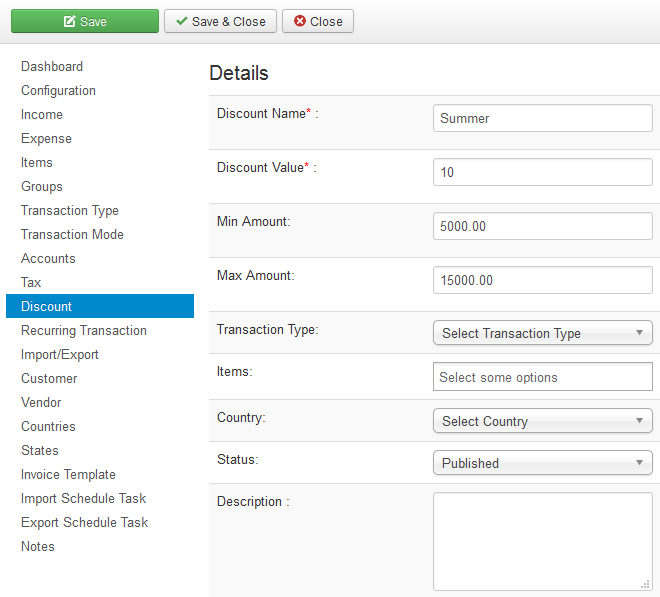

- To create a Discount Calculation Rule, you can simply click on new button in the toolbar and fill-in necessary information.

The table below list the important fields and it's meaning which you need to enter when you setup tax.

| Property | Description |

|---|---|

| Discount Name | Name of your Tax Calculation Rule |

| Discount Value (in %) | Set Tax value in Percentage (%). |

| Minimum Amount | Set the Minimum Amount of Income/Expense Transaction on which this Discount Rule can be Apply. |

| Maximum Amount | Set the Maximum Amount of Income/Expense Transaction on which this Discount Rule can be Apply. |

| Items | Select items on which you want to apply this Discount Calculation Rule. You can select multiple items from the list. If you want to apply this Discount Calculation Rule to all Items then leave it Blank. |

| Country | Select country on which you want to apply this Discount Calculation Rule. If you want to apply this Discount Calculation Rule to all Countries then select “Select Country”. |

| Status | Set this Discount Calculation Rule status to Published/Unpublished. |

| Description | Set your Description about this Discount Calculation Rule. |